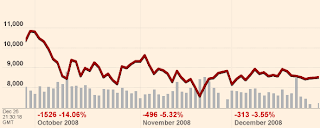

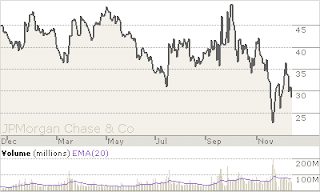

Decembe- 31 2008 Stock Market

Index: 8,776.39 Chg: 108.00 %Chg: 1.25% YTD% Chg: -33.8% Stocks Extend Advance in Year's Final Session- AP Wall Street headed toward a merciful end to a dreadful year Wednesday as investors took some comfort from a sharp drop in weekly unemployment claims and focused on the prospects for 2009. Initial claims for state unemployment insurance benefits fell to a seasonally adjusted 492,000 in the week ended Dec 27 from an unrevised 586,000 the prior week, the Labor Department said. It was the lowest reading for initial claims since the week ended November 1, 2008, and the steepest decline since 1992.